Accounting Project

Darren Chung-Ta Chang, Ryan Hsu, Andrea Kao, George Chao-Chih Ko April 24, 2002

|

Accounting ProjectDarren Chung-Ta Chang, Ryan Hsu, Andrea Kao, George Chao-Chih Ko April 24, 2002 |

Case Study: Lille Tissages, S. A.

The

case being investigated involves a large French textile company, Lille Tissages,

S.A., facing stiff competition and whose managers are forced to reconsider

pricing plans for Item 345, one of their most successful products.

As shown in Exhibit 1, Lille Tissages has lost significant market share on Item 345 in recent years. At its prime, the firm commanded 35% of industry-wide production of the particular item. However, the estimated percentage for the year prior to the date of the case study has faltered to about 20%.

To remedy the staggering market share lost, high profile officials of the company are analyzing a possible pricing strategy, proposed by the sales director, for Item 345 in an effort to regain ground. The sales director proposed that if the firm were to reduce the price of Item 345 to FF15, they would be able to increase sales to 175,000 (or 25% of industry production) units. If the firm were to keep the price at the current value of FF20, they would only be able to sell 75,000 units (and no less).

The focus of the study will discuss implications of price of Item 345 by addressing the following points:

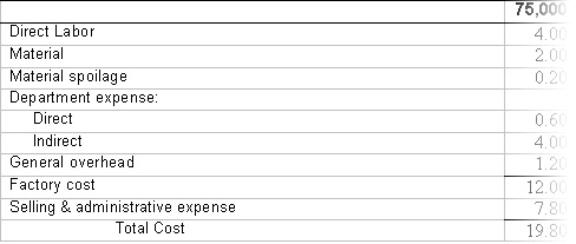

The study group has approached the problems from the standpoint of unit contribution margin and total contribution. In order to use this approach, the team has to first identify the variable and fixed costs in producing Item 345 (see Exhibit 2).

The following are declared as variable cost: direct labor, material, material spoilage, and direct department expense. All these items are charged on a per-item produced basis. Indirect department expense is considered fixed because the cost is sunk regardless of the level of production. General overhead and selling & administrative expenses are company fixed costs applied to the division.

Also

note that the team disagrees with the method Lille Tissages, S.A. uses to apply

General Overhead costs. The team

argues that the description given to General Overhead (administrative,

occupancy, supervision, etc) suggests that it should be considered a fixed

amount, which means it should decrease a the number of units produced increases.

To find this fixed amount, the team decided to use the average of the

total General Overhead from volumes that were produced in previous years.

The issue at hand is whether the firm would benefit as a whole in the proposed price drop. Changing the unit sales price will alter the unit contribution margin (CM), which is the sale price minus variable cost. Analysis shows (refer to Exhibit 3) that at a selling price of FF20, the CM is FF13.20 per meter. If Lille Tissages is to follow through with the new pricing plan and drop the sales price to FF20, the unit CM will fall from FF13.20 to FF8.51.

With the contribution margin calculated, the total contribution can be evaluated for the two production levels. At FF20, sales volume is predicted to be 75,000 units. Therefore, the estimation of the total contribution would be FF990,000 (FF13.20×75,000). The sales director is certain that the company could sell 25% of the 1997 industry total, or 175,000 units, if it adopted the FF15 price. At these rates, the total contribution is calculated to be FF1,489,250 (FF8.51×175,000).

At first glance, per unit contribution margin calculations connote a feeling that the firm should not drop the price to FF15 since sales price of FF20 shows much higher contribution margin per unit. However, total contribution calculations clearly indicate that selling a larger volume at a lower price will result in higher contributions towards fixed costs. From contribution standpoint, Lille Tissages should drop the price to increase demand, and ultimately derive higher total contributions towards the company’s fixed costs.

WILL

THE ITEM 345 DEPARTMENT LIKELY TO AGREE WITH THE LOWERING OF COSTS?

This question concerns the situation where the department producing Item 345 is to be considered a profit center. By definition, a profit center is an organizational subunit whose manager is held accountable for profit. From this viewpoint, the main issue at hand is under which pricing plan would Department 345 gain more profit, that is, higher revenue and lower expenses?

At selling price of FF20 and sales volume of 75,000 units, the total revenue is estimated to be FF1.5 million and total expense FF1.64 million (refer to Exhibition 3). Total expense minus total sales gives negative profit of FF0.14 million. Similarly, for the selling price of FF15 and sales volume of 175,000 units, the total revenue is estimated to be FF2.63 million and total expense FF2.68 million. These figures result in negative profit of FF0.05 million.

Based

on the estimation of total expense and total sales, selling prices of FF15 and

FF20 will both result in non-positive profits, or lost of earnings, but losing

less at price FF15. Since the goal

of a profit center manager is to maximize profit in any situation, he would

likely agree to sell Item 345 at the lower price of FF15.

If Lille Tissages maintains its price of FF20, their

competition may raise their prices, as long as their contribution margin is

higher than their margin at a lower price.

One impact of their increase in price these competitors must consider is

the inevitable fact that they will begin to lose market share since the general

public of the textile industry believe that Lille Tissages produce better

product. Given this situation, the

competitors will have to perform a thorough market research similar to Lille

Tissages to determine how much market share they would loose if they raise their

price and what the optimum price would be to bring them the largest contribution

margin per unit.

At the same time, when the competitors of Lille

Tissages loses their market share, Lille Tissages would very likely be the

beneficiary of this particular sector of the market. As a result, Lille Tissages will likely to have a different

sales volume, more specifically higher than 75,000 units (which they have

originally anticipated at the price of FF20).

As one can see from Exhibit 3, when Lille Tissages can sell 125,000

units, or a market share as high 17.85% (125000/700000), at FF20, the company

will be able to make a higher profit than selling 175,000 units at FF15 even

though the lower price has a higher market share of 25%.

Since FF15 is high enough to cover factory costs at

the 175,000 production level, profitability of Item 345 will depend on how much

of the company’s Selling & Administrative Expenses is allocated to this

department. With the current

allocation practice (65% of the factory cost), Lille Tissage will not see profit

on Item 345. The reason being that

too much overall company selling and administrative expense allocated to this

department.

Suppose that Lille Tissages changes its allocation

practices. The point at which the

company sees neither profit nor loss is about 62% at FF15 (see Exhibit 4), i.e.

if the percentage of Selling & Administrative expenses allocated to this

department is lower than 62%, then Lille Tissage sees a profit on this item.

Otherwise, the company will see a lost on this investment.

In addition, consider the situation from the

perspective of the firm. Since one

does not know the overall fixed cost for the company, the sales revenue

generated at the set price may already cover the overall fixed of the company

and therefore the Item 345 is already making a profit.

Lastly, since it was stated that any action taken on Item 345 would not

have any substantial impact on the sales of the other product lines, one does

not need to consider the possibility of selling Item 345 at a loss and recover

that loss by the increase in sales profits at the other product lines.

From

our analysis above, Lille should lower the price to FF15 in order to benefit the

company as a whole. However, the

product is very competitive. The company has to prepare a strategy to make this item

profitable. We have prepared a

long-term analysis for item 345. Our

analysis shows that Lille shall lower the price and try to force some

competitors out of business. As a

result, Lille can gain more market share at a high contribution margin.

The following is our long-term analysis.

Assumptions:

Based

on the above assumptions, we analyze the possible outlooks of item345 for three

different pricing schemes. The

three schemes are: 1) FF20 for the next four years.

2) FF15 for the next four years. 3)

FF14 for the first two years and FF22 for the last two years.

As shown in the following graph, scenario 3 can generate the most of

operating income. Operating income

is calculated as total contribution margin minus total department fixed cost.

In addition, scenario 3 has the highest NPV among three scenarios. Clearly, Lille Tissages should adapt scenario 3 as its

long-term strategy for item 345. Please

refer to Exhibit 5 for detail calculations.

In

Scenario 3, Lille Tissages lowers the price to FF14 for 1997 and 1998 to gain

more market shares. Since Lille’s

competitors all have higher costs and some of them are in tight financial

straits, its’ competitors will be driven out of business if they cannot follow

the price reduction in the first two years.

As a result, Lille Tissages can absorb their market share and raise the

price to FF22 at the end of 1998. However,

some of Lille’s competitor ought to survive, but they are small and have

limited capacity. As the supply

reduces while demand increases, the price of item 345 will increase.

This is the reason why Lille Tissages can raise the price and gain more

market share in 1999. The Lille

Tissages’ estimated market share is 35%, 40%, 45% and 45% for 1997, 1998, 1999

and 2000, respectively.

Exhibit

1 Item 345, Prices and Production,

1991-1996

|

|

Volume of Production (meters) |

Price (French francs) |

||

Year |

Industry Total |

Lille Tissages |

Charged by Most Competitors |

Lille Tissages |

|

1991 |

610,000 |

213,000 |

20.00 |

20.00 |

|

1992 |

575,000 |

200,000 |

20.00 |

20.00 |

|

1993 |

430,000 |

150,000 |

15.00 |

15.00 |

|

1994 |

475,000 |

165,000 |

15.00 |

15.00 |

|

1995 |

500,000 |

150,000 |

15.00 |

20.00 |

|

1996 |

625,000 |

125,000 |

15.00 |

20.00 |

Exhibit 2

Cost Categories in Producing Unit of Item 345

Exhibit 3

Calculation of Short-term Analysis

|

Unit |

75000 |

100000 |

125000 |

150000 |

175000

|

200000

|

|

Direct

Labor |

4.00 |

3.90 |

3.80 |

3.70 |

3.80 |

4.00 |

|

Material |

2.00 |

2.00 |

2.00 |

2.00 |

2.00 |

2.00 |

|

Material

spoilage |

0.20 |

0.20 |

0.19 |

0.19 |

0.19 |

0.20 |

|

Department

expense: |

|

|

|

|

|

|

|

Direct |

0.60 |

0.56 |

0.50 |

0.50 |

0.50 |

0.50 |

|

Indirect |

4.00 |

3.00 |

2.40 |

2.00 |

1.71 |

1.50 |

|

Avg

General Overhead˚ |

2.50 |

1.87 |

1.50 |

1.25 |

1.07 |

0.94 |

|

Factory

cost |

13.30 |

11.53 |

10.39 |

9.64 |

9.27 |

9.14 |

|

Selling

& Admin Expense |

8.64 |

7.50 |

6.75 |

6.26 |

6.03 |

5.94 |

|

Total

Cost Per Unit |

21.94 |

19.03 |

17.14 |

15.90 |

15.29 |

15.07 |

|

|

|

|

|

|

|

|

|

Total

Variable Cost per Unit |

6.80 |

6.66 |

6.49 |

6.39 |

6.49 |

6.70 |

|

Total

Fixed Cost Per Unit |

6.50 |

4.87 |

3.90 |

3.25 |

2.78 |

2.44 |

|

|

|

|

|

|

|

|

|

Selling

Price |

20.00 |

20.00 |

20.00 |

20.00 |

20.00 |

20.00 |

|

Contribution

Margin |

13.20 |

13.34 |

13.51 |

13.61 |

13.51 |

13.30 |

|

Total

Contribution (CM

× #Units) |

990,000.00 |

1,334,000.00 |

1,688,750.00 |

2,041,500.00 |

2,364,250.00 |

2,660,000.00 |

|

|

|

|

|

|

|

|

|

Selling

Price |

15.00 |

15.00 |

15.00 |

15.00 |

15.00 |

15.00 |

|

Contribution

Margin |

8.20 |

8.34 |

8.51 |

8.61 |

8.51 |

8.30 |

|

Total

Contribution Margin |

615,000.00 |

834,000.00 |

1,063,750.00 |

1,291,500.00 |

1,489,250.00 |

1,660,000.00 |

|

|

|

|

|

|

|

|

|

Total

Fixed cost |

487,125.00 |

487,125.00 |

487,125.00 |

487,125.00 |

486,375.00 |

487,125.00 |

|

|

|

|

|

|

|

|

|

Total

Expense |

1,645,256.25 |

1,902,656.25 |

2,142,318.75 |

2,385,281.25 |

2,676,506.25 |

3,014,756.25 |

|

Total

Sales at FF20 |

1,500,000.00 |

2,000,000.00 |

2,500,000.00 |

3,000,000.00 |

3,500,000.00 |

4,000,000.00 |

|

Total

Sales at FF15 |

1,125,000.00 |

1,500,000.00 |

1,875,000.00 |

2,250,000.00 |

2,625,000.00 |

3,000,000.00 |

|

Expect

Profit˚˚ |

-145,256.25 |

|

|

|

-51,506.25 |

|

|

|

|

|

|

|

|

|

|

˚The

team had decided that general overhead should be a fixed constant cost,

regardless of the number of units produced.

The total overhead is fixed, and is calculated below via an

averaging of past overheads. |

||||||

|

Total

General Overhead |

90,000.00 |

117,000.00 |

142,500.00 |

166,500.00 |

199,500.00 |

240,000.00 |

|

Average

General Overhead |

187,125.00 |

187,125.00 |

187,125.00 |

187,125.00 |

187,125.00 |

187,125.00 |

|

Avg

Gen Overhead Per Unit |

2.50 |

1.87 |

1.50 |

1.25 |

1.07 |

0.94 |

|

|

|

|

|

|

|

|

|

General

overhead |

1.20 |

1.17 |

1.14 |

1.11 |

1.14 |

1.20 |

|

|

|

|

|

|

|

|

|

˚˚Expected

profit calculation for production of 75,000 uses total sales at FF20. Expected profit calculations for production of 175,000 uses

total sales at FF15 |

||||||

Exhibit 4

Desired Selling & Administrative Expense Allocation Calculation

|

Unit |

|

175000

|

|

Total

Variable & Fixed Cost ˚ |

|

1622125.00 |

|

Total

Sells & Admin Expense˚˚ |

|

1054381.25 |

|

Desired

Highest Sell & Admin Allocation˚˚˚ |

|

1002875.00 |

|

Factory

cost |

|

9.27 |

|

Desired

% allocation of Factory Cost |

|

0.62 |

|

Total

Expense |

|

2676506.25 |

|

Total

Sales at FF15 |

|

2625000.00 |

|

|

|

|

|

˚This

is calculated by: (Variable Cost Per Unit + Fixed Cost Per Unit) x Units |

||

|

˚˚This

is calculated by: Sells &

Administrative Expense x Units |

||

|

˚˚˚This

is calculated by: Expected

Total Sale - (Total Variable & Fixed Cost) |

||

Exhibition

5 Calculation of

Long-term Analysis

|

|

Volume

of Production (meters) |

Price (French francs) |

|

|

|

|

|

||||||

|

Scenario 1 |

Industry

Total |

Lille

Tissages |

Charged

by most Competitors |

Lille

Tissages |

VC |

CM |

FC |

O.

Income |

|||||

|

1997 |

700000 |

75000 |

15 |

20 |

6.80

|

13.20

|

487125 |

502875 |

|||||

|

1998 |

770000 |

75000 |

15 |

20 |

6.94

|

13.06

|

496867.5 |

482932.5 |

|||||

|

1999 |

847000 |

75000 |

15 |

20 |

7.07

|

12.93

|

506804.9 |

462591.2 |

|||||

|

2000 |

931700 |

75000 |

15 |

20 |

7.22

|

12.78

|

516940.9 |

441843 |

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

NPV |

1656174 |

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Volume

of Production (meters) |

Price (French francs) |

|

|

|

|

|

||||||

|

Scenario 2 |

Industry

Total |

Lille

Tissages |

Charged

by most Competitors |

Lille

Tissages |

VC |

CM |

FC |

O.

Income |

|||||

|

1997 |

700000 |

175000 |

15 |

15 |

6.49

|

8.51

|

487125 |

1002125 |

|||||

|

1998 |

770000 |

192500 |

15 |

15 |

6.83

|

8.17

|

496867.5 |

1075088 |

|||||

|

1999 |

847000 |

211750 |

15 |

15 |

6.97

|

8.03

|

506804.9 |

1193404 |

|||||

|

2000 |

931700 |

232925 |

15 |

15 |

7.22

|

7.78

|

516940.9 |

1296097 |

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

NPV |

3939538 |

|||||

|

|

Volume

of Production (meters) |

Price (French francs) |

|

|

|

|

|

||||||

|

Scenario 3 |

Industry

Total |

Lille

Tissages |

Charged

by most Competitors |

Lille

Tissages |

VC |

CM |

FC |

O.

Income |

|||||

|

1997 |

700000 |

245000 |

15 |

14 |

6.80

|

7.20

|

487125 |

1276875 |

|||||

|

1998 |

770000 |

308000 |

15 |

14 |

7.04

|

6.96

|

496867.5 |

1647429 |

|||||

|

1999 |

847000 |

381150 |

15 |

22 |

7.28

|

14.72

|

506804.9 |

5102656 |

|||||

|

2000 |

931700 |

419265 |

15 |

22 |

7.39

|

14.61

|

516940.9 |

5609846 |

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

NPV |

11206368 |

|||||

Copyright

@ Andrea Kao, Cornell University

[email protected]